Understanding fuel surcharges in freight shipping is an important detail to know for shipping in the United States. While most freight carriers will provide you with accurate and honest information, it doesn’t hurt to have the knowledge of the surcharge calculation process in advance.

Key Takeaways

If you’re confused about fuel surcharges, our article is here to help you learn why carriers have to use them and how to estimate what those fees should be based on current information.

A fuel surcharge is an additional fee added to freight shipments when the cost of fuel exceeds the current average. According to the U.S. General Services Administration, a fuel surcharge is designed for transportation service providers (TSPs) to reimburse them for the cost of fuel used during the shipping process when its cost goes beyond an established threshold.

The U.S. Energy Information Administration (EIA) mentions that it’s up to a company to determine the way they’ll set up their fuel charges. They go on to say there’s not one method of calculation inherently superior to another, nor do they mandate any particular surcharge calculation formula.

As a shipper, you will pay the truckload fuel surcharge to other parties like carriers, freight forwarders, and freight brokers. Keep in mind when shopping for carriers that these surcharges are subject to change based on increasing and decreasing fuel prices.

As briefly mentioned above, fuel surcharges give TSPs (including freight carriers) legal recourse for recouping costs associated with sudden, unpredictable spikes in fuel prices. While some shippers might see it as “just another fee”, in a way, this charge benefits them as well. Without it, flat rates would be higher across the board and would not take distance or variations in fuel prices from region to region into account.

Knowing that you’re likely to encounter these fees as a shipper, it’s important to understand how carriers determine the fuel surcharge fee for a given shipment.

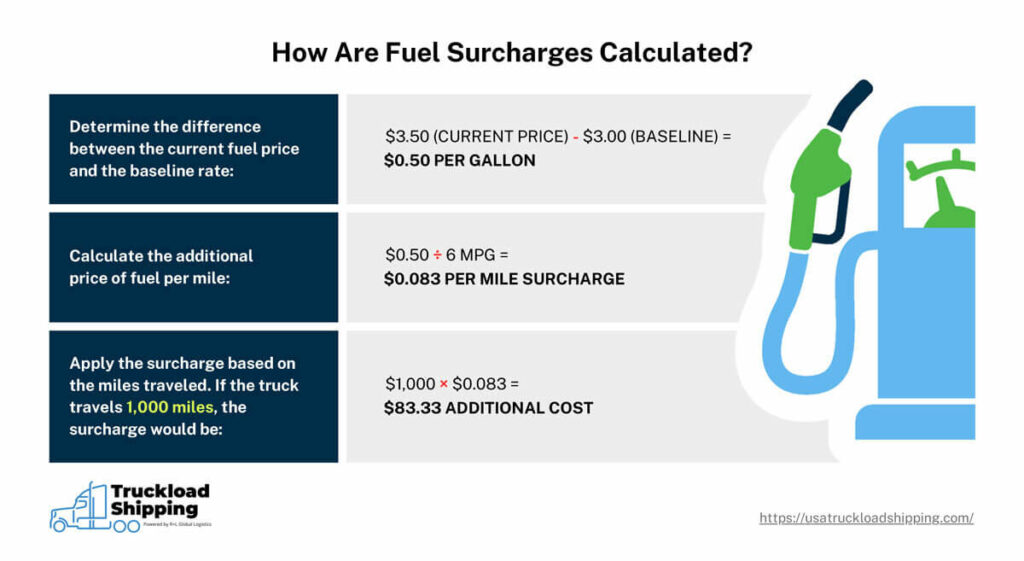

The most common method for calculating a fuel surcharge is by applying an additional percentage fee whenever fuel prices exceed a pre-established baseline rate. The surcharge is determined by considering the difference between the current fuel price and the baseline rate, along with the fuel efficiency of the vehicle. This is sometimes called a rate-per-mile fuel surcharge program

For example, let’s say a carrier has a surcharge baseline rate of $3.00 per gallon. If the current nationwide fuel price average is $3.50 per gallon according to the EIA, and the truck in question gets 6 miles per gallon (MPG), the surcharge can be calculated as follows:

Shippers and carriers can also use online tools like the OOIDA Fuel Surcharge Calculator to simplify this process.

It’s also worth keeping in mind that certain carriers will use the average within a given petroleum administration for defense district (PADD) rather than the nationwide average when calculating the fuel surcharge.

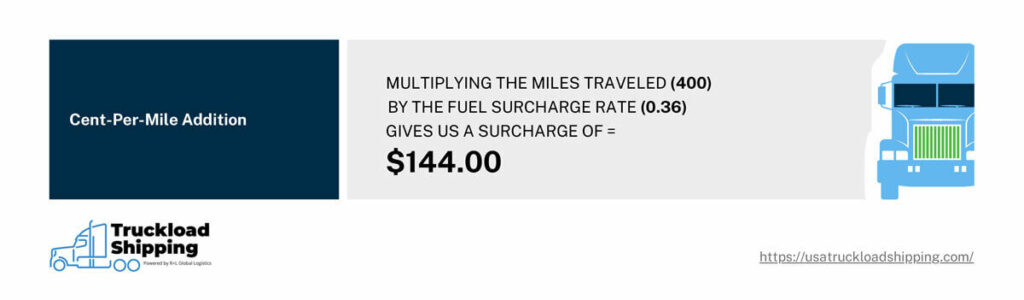

Some carriers determine their fuel surcharge rates by making them a cent-per-mile addition to the overall line haul fee. The higher the cost of fuel, the higher the additional fee.

For instance, if the same company I just mentioned booked a 500-mile haul with a general line haul rate of $4.00 per mile, the resulting fee is $2,000. However, since the fuel cost is above the established rate, the carrier assesses another 36 cents per mile as a surcharge.

Multiplying the miles traveled (400) by the fuel surcharge rate (0.36) gives us a result of $144.00.

Now that you know the definition of a fuel surcharge and how to calculate it, let’s address some common questions that come along with this fee.

For a deeper understanding of additional charges associated with trucking, check out this comprehensive guide on truckload accessorial charges.

Fuel surcharges are subject to minimal federal regulation, with the most notable rule being the Pass-Through of Motor Carrier Fuel Surcharge Adjustment to the Cost Bearer. This regulation ensures that fuel surcharges collected by brokers, freight forwarders, and other intermediaries are passed on to the actual cost bearer—the trucking company or carrier responsible for purchasing fuel.

Beyond this requirement, there are no standardized federal or state regulations governing how fuel surcharges should be structured or applied. Instead, most rules and policies regarding fuel surcharges are established by the carriers themselves. This means that:

Because of these factors, you should always review individual carrier policies regarding fuel surcharges for the sake of transparency. You may also be able to use this knowledge to negotiate terms more favorable to your business prior to contracting with a carrier.

Fuel surcharges usually cannot be adjusted on a shipment-by-shipment basis, as they are based on fluctuating fuel costs. However, there can be some wiggle room under the right circumstances, particularly for shippers looking for long-term contracts.

Some of the steps shippers can take to ensure a fair fuel surcharge policy before committing to a carrier are:

By addressing fuel surcharge policies before signing an agreement, businesses can make their shipping expenses more predictable.

For businesses looking for a reliable and strategic partner in freight shipping, USA Truckload Shipping offers comprehensive transportation solutions across the United States. With a commitment to fair pricing, punctuality, and customer satisfaction, we provide a professional shipping experience tailored to your needs.

Our services Include:

Partner with USA Truckload Shipping for dependable freight solutions tailored to your business. Call us at (866) 353-7178 or submit an RFP here to get started. We’re standing by to help you ship your goods out safely and swiftly.

R+L Global Logistics

315 NE 14th St., Ocala, FL 34470

What if the company I’m leased to decided to start taking 10% of my FSC. Is this something they can do?

I was told that fuel surcharge is a federal law that a owner operator we'll get a fuel surcharge. But a company that I know of does not have a fuel.Surcharge they don't ask their customers for a fuel surcharge. I was wondering if I could get someone to show me.The federal law federal statute that states it is a federal law

Hello. If a person collects $30.00 fuel surcharge do they have to pay all of it to the trucking company?